Fed-State Differences

Purpose.

The purpose of this page is to identify & provide guidance on the manual entries required in the Maine section of the 2018 TaxSlayer® software application in order to prepare an accurate Maine return.

Manual Entries in TaxSlayer®’s MAINE module

In the sections below you will find information about how to handle specific manual entries into the TaxSlayer®’s Maine module to account for DIFFERENCES between Federal & Maine tax laws.

Maine’s individual tax return - an overview.

Maine’s tax return begins with Federal Adjusted Gross Income (AGI). Because there are a few areas of nonconformity with Federal tax laws, modifications are made to arrive at Maine AGI.Modifications to Income found on Schedule 1

Modifications to Federal AGI to arrive at Maine AGI are compiled on Schedule 1.Schedule 1 - Additions when income is taxable by the state but not at Federal level.

Schedule 1 - Subtractions when income is taxable at the Federal level but not by the state.

Adjustments to Tax found on Schedule A

After taxable income has been derived and tax assessed, Adjustments to Tax are made in the form of tax credits on Schedule A. There is a tax credit worksheet for each tax credit. The tax software completes these worksheets in most cases. You can access those worksheets at Maine.gov Worksheets for Tax Credits - 2019 (click). These credits are reported onSchedule A, Section 1 if they are Refundable tax credits

Schedule A, Section 2 if they are Nonrefundable tax credits

Maine - TaxSlayer® Home screen.

The screens for making the manual entries highlighted below can be accessed by BEGINning or EDITing the Menu selections on the main Menu (see image below)

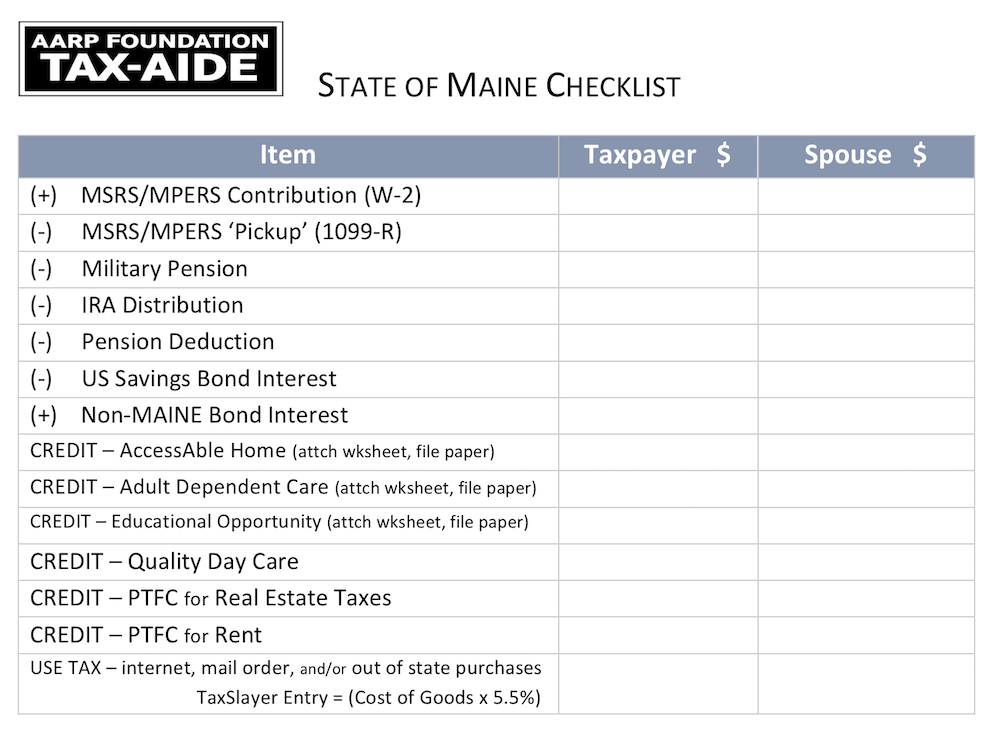

It is a common practice to use a Checklist (image below at right) to keep track of the manual entries, which represent tax items that are treated differently at the Federal level and the Maine level, that we will need to make once we complete the Federal return and move on to the state of Maine module.

Schedule 1 - INCOME MODIFICATIONS (Additions)

Below is TaxSlayer®’s Menu options for Additions to Maine Income in order to arrive at Maine Adjusted Gross Income.

Manual entries may be necessary for only 2 menu items:

Income from Other State Bonds (only necessary if not identified in the Federal 1099-INT input)

Maine Public Employees Retirement Contributions

Interest

(+) Line 1a, Income from other state bonds

Maine will not tax interest income from its own state and municipal bonds but it does place a tax on the interest derived from other state & municipal bond interest.

While in the Federal section of TaxSlayer, after entering basic entries from 1099-INTs, consider whether tax differences are present so that you can ‘stick’ the necessary Maine adjustments at the same time.

The image at right shows amounts in Box 3 & Box 8. Let’s say you discovered the tax exempt income in Box 8 for $411 came from a New Jersey municipal bond. This would imply that Maine will tax that interest income.

Scroll to the bottom of the entry screen to make your adjustments. These entries will automatically carry to the Maine return.

If you identified the amount in Box 8 of 1099-INT as a Taxable State Interest Item (as in image to right) when you input the income from the 1099-INT, do not enter it again from the Maine state module.

If you did not identify the interest shown in Box 8 of 1099-INT as a Taxable State Interest Item then you will select Income from Other State Bonds (first starred item in image above) and enter the amount as an Addition to Income.

Interest: Is it Taxable in Maine? - document published by Maine Revenue

W-2 Contributions to MPERS Pension

(+) Line 1c, Maine Public Employees Retirement System Contributions

Taxpayers contributing to the Maine State Retirement System (MPERS) will have a pension contribution amount in Box 14 of form W-2 with a code of MSRS or MPERS (see image below, item labeled #4).

MPERS is Maine’s version of Social Security. Therefore, Social Security Wages in Box 3 will be $0.00 (see image, labeled #2).

It is important to remove the number that will automatically populate this box on the W-2 input screen once Wages are entered into Box 1.Medicare wages in Box 5 is the full amount of wages earned by taxpayer. Ensure that you have the correct amount entered in this box and override the amount that TaxSlayer has provided as an automatic calculation (see image #3)

Maine taxes, as wages, the amount of pension contribution when it is made, unlike the tax favored treatment of pension contributions at the federal level (see image #1 - Federal wages & #5 - Maine wages).

Maine wages will be higher than the federal wages. This adjustment is made automatically by TaxSlayer.

SCHEDULE 1 - INCOME MODIFICATIONS (Subtractions)

!!! Under construction !!! (add Screenshots)

US Bond Interest in Federal AGI

(-) Line 2a, U.S. Government Bond interest included in federal adjusted gross income

This US Gov’t Bond interest is not taxable in Maine but it is taxable at the federal level. If you designated this distinction in the Federal income entry screen when transcribing the 1099-INT by identifying the interest income as excludable at the state level, TaxSlayer will carry that Subtraction modification to the Maine return.

From the Federal Income section while entering the interest, scroll to the bottom of the screen to make the designation (see image)

If you did not make this designation in the 1099-INT entry screen in the Federal section you must make the entry in the Maine state section.

Interest: Is it Taxable in Maine?

State Bond Interest

(-) Line 2b, State Bond Interest

Warning!! MAINE State Bond Interest – Since it’s exempt at the federal level it is NOT included in federal income or Fed AGI. No adjustment is needed.

Pension Income Deduction

(-) Line 2d, Pension Income Deduction

Enter total eligible pension amounts for taxpayer & spouse separately; no double counting such that each pension is represented only once.

This is covered on the Maine Retirement Income page.

1099-R Distributions From MPERS pension

(-) Line 2f, Pre-taxed State Retirement System Pickup Contributions

State employees with 1009-R’s may have pre-taxed ‘pick-up’ contributions. If there is a difference between Box 2a and Box 14, enter the difference here.

This is covered on the Maine Retirement Income page.

Medical Marijuana Business Expenses

(-) Line 2i, Medical Marijuana Business Expenses

Medical use of marijuana business expense. A deduction may be claimed for expenses related to carrying on a business as a registered caregiver or a registered dispensary, in an amount equal to the deduction that would otherwise be allowable for Maine purposes to the extent the deduction was disallowed under Internal Revenue Code.

Because of the differences in the Maine & Federal laws, the business expenses that are not allowed at the federal level ARE allowed on the Maine return to the extent that they are allowed as ordinary & necessary business expenses.

This is discussed on the Maine - Changes in 2018 page as a Subtraction from Income on Schedule 1.

SCHEDULE A - Adjustments to Tax

Once Maine AGI (Line 16) has been determined, Deductions (Line 17) and Exemptions (Line 18) applied, Taxable Income (Line 19) determined and the taxpayer’s Tax liability (Line 20) is calculated, then eligible Tax credits are considered.

Listed below are some of the most common tax credits we see.

(starred items in images below):

Child Care TAX Credit

2018 Double Tax Credit Eligible Licensed Child Care Providers

What do I need to know?

There are 3 Maine Tax Credits that are bundled together on a one-page Worksheet.

These are:

Worksheet for Child Care Credit - Sch A, Lines 1 & 9

Worksheet for Earned Income Tax Credit - Sch A, Lines 3 & 11

Worksheet for Dependent Exemption Tax Credit - Sch A, Line 8

The GOOD News is that only the Child Care Credit requires your special attention.

The credit may be either Nonrefundable or Refundable.

When the taxpayer has used a “Quality Care” child care provider, a manual entry must be made in the TaxSlayer® Maine module.

If “Quality Care” was used, the taxpayer may be eligible for a refund of up to $500.

If non-“Quality Care” was used, the taxpayer would be eligible for a credit against tax owed on the Maine return of 25% of the Federal child care credit.

What is “Quality Care”?

Maine lawmakers passed a law that increases the Child care credit for specially certified child care centers.

Taxpayers who enrolled their dependent child(ren) in a child care center that has taken the extra step to obtain a Step 4 Quality Certificate is eligible for a double child care tax credit.

An automatic calculation is made using information flowing from the Federal return such that an individual is allowed a credit against the tax otherwise due in the amount of 25% of the federal tax credit allowable for child and dependent care.

The credit doubles - 50% of the Federal tax credit - if the child care expenses were incurred through the use of quality child care.

Don’t misconstrue the meaning of “Quality Care”. This is NOT a judgement regarding non-”Quality Care” child care providers. It is more or less a performance scorecard that “Quality Care” providers have subjected themselves to in order to be accredited. (click for more information)

2018 Double Tax Credit Eligible Licensed Child Care Providers

Credit for taxes paid to another state

Credit for taxes paid to other jurisdictions

When a taxpayer files as a Maine resident, declares non-resident income in other states and pays income tax to those other states, Maine will tax all of the income and then provide this credit for the Taxes Paid to Other Jurisdictions.

Adult Dependent Care Credit

Adult Dependent Care Credit

Download Worksheet (Adult Dependent Care)

This Credit might be a Refundable Credit or Nonrefundable Credit.

Follow the Instructions (which define and establish a Qualified Individual and Qualified Expenses) to fill out the short Adult Dependent Care Worksheet then manually enter amount in the Maine module of the tax software under CREDITS menu.

Based on taxpayer eligibility, the credit will be either Nonrefundable or Refundable.

Your Worksheet calculation will be carried to either

Schedule A, Line 2 or

Schedule A, Line 9

NOTE that the software will make the determination of Nonrefundable or Refundable.

AccessAble Home Tax Credit

Credit for Certain Homestead modifications

The entry screen is located on the OTHER Credits menu identifiable as AccessAble Home Tax Credit (first starred item image above)

Download Worksheet (AccessAble Home Tax Credit)

See instructions for Schedule A, Line 20

Do you qualify? - Maine Housing Authority explains the eligibility requirements and steps to take.

Program Guidelines, Request for Certification & Application Instructions

Instructions - Maine Revenue Service

The scenario presented in the Sample return (below) has both tax credits.

Beware! You are entering different values into the software. (screenshots below)

Adult Dependent Care entry is the full amount of expenses

AccessAble Home Tax Credit is the calculated credit carried from the worksheet.

Sales Tax Fairness Credit / Property Tax Fairness Credit

For more information these tax credits are discussed on this site at STFC/PTFC Page

Sales Tax Fairness Credit

This credit is calculated automatically. The worksheet result will be carried to Form 1040ME, line 25e.

Property Tax Fairness Credit

Input is required for either the taxpayer’s rent or property tax.

Educational Opportunity Tax Credit

Maine Educational Opportunity Tax Credit

The entry screen is located on the OTHER Credits menu identifiable as Credit for Educational Opportunity (second starred item on the image above at right)

Maine resident taxpayers who are paying off their student debt and are in compliance with a few other criteria for eligibility, may claim this tax credit.

The eligibility requirements are discussed on this site on the Maine Educational Opportunity Tax Credit page.