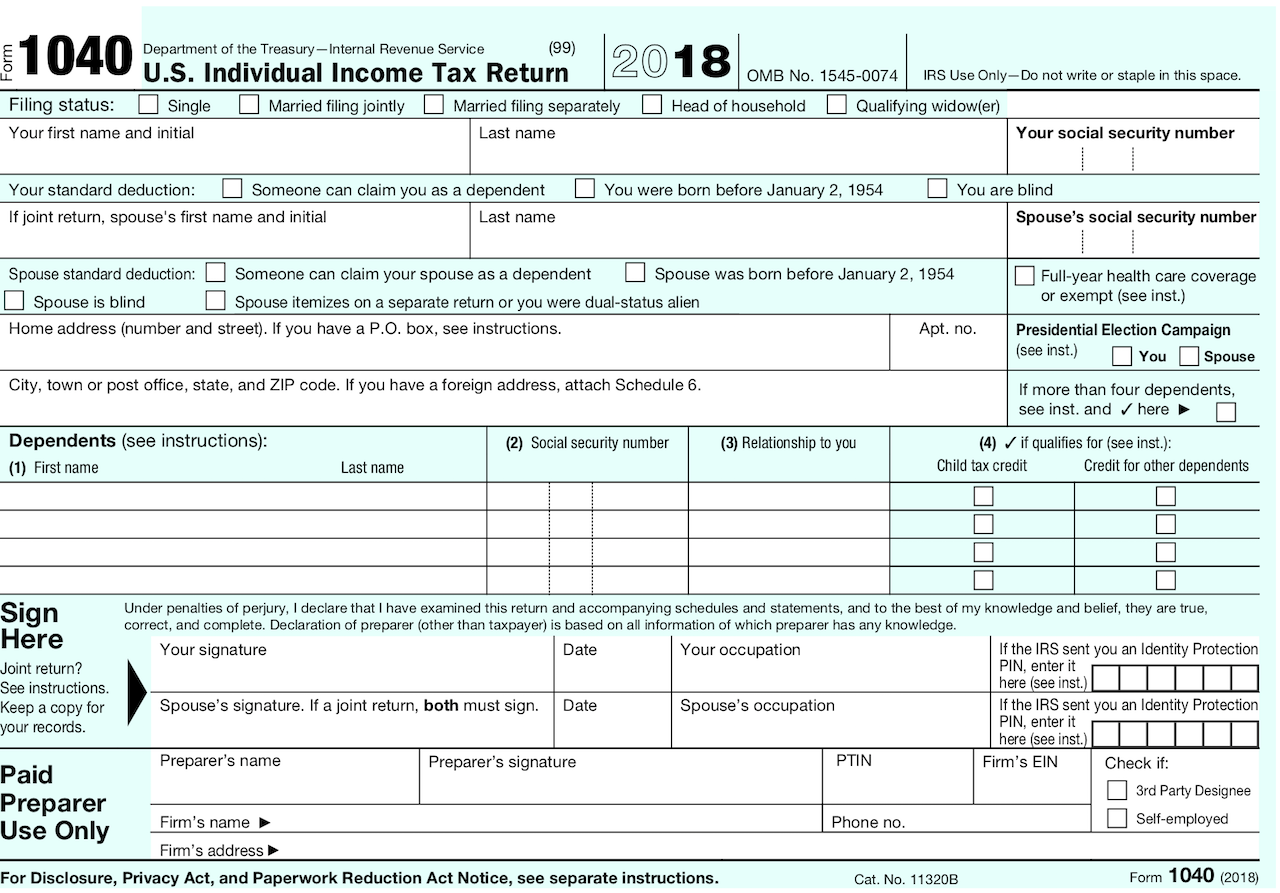

2018 Form 1040 - Individual Income Tax Return

significant changes you are going to notice

It’s a Postcard! Many of the seldom used lines from the prior year Form 1040 have been offloaded to a suite of new Schedules. PLUS! There are no 1040As and no more 1040EZs.

2017 Tax Cuts and Jobs Act (TCJA) made significant changes to the Child Tax Credit, the Additional Child Credit and added a new credit called Other Dependents Credit.

TCJA also added a new deduction that most of our Schedule C clients will be eligible for called the Qualified Business Income Deduction.

All changes are outlined on Link & Learn, in Pub 4491, and Pub 4012.

Major topics will be discussed in this section but the biggest change is the Form 1040’s new look.

Introducing Schedules 1 through 6

Below is a brief introduction to these new Schedules. Jump to a specific Schedule (location) by clicking below or just scroll down.

FORM 1040 REDESIGNED FOR 2018

This is going to take a little getting used to.

Veteran volunteers expect tax law changes from one year to the next.

We hang around the IRS website in late December looking for Pub 4491X to see if all the ‘extenders’ will be approved. We adapt quite easily to all the annual changes.

But the one constant thing we could count on was the format of Form 1040. Most of us could recite from memory each line of the old 1040. We thought it was fine just the way it was.

Well, change is hard but there is good news! All the old line items are still with us.

The line items found in prior year’s Form 1040 remain but have been offloaded onto various schedules.

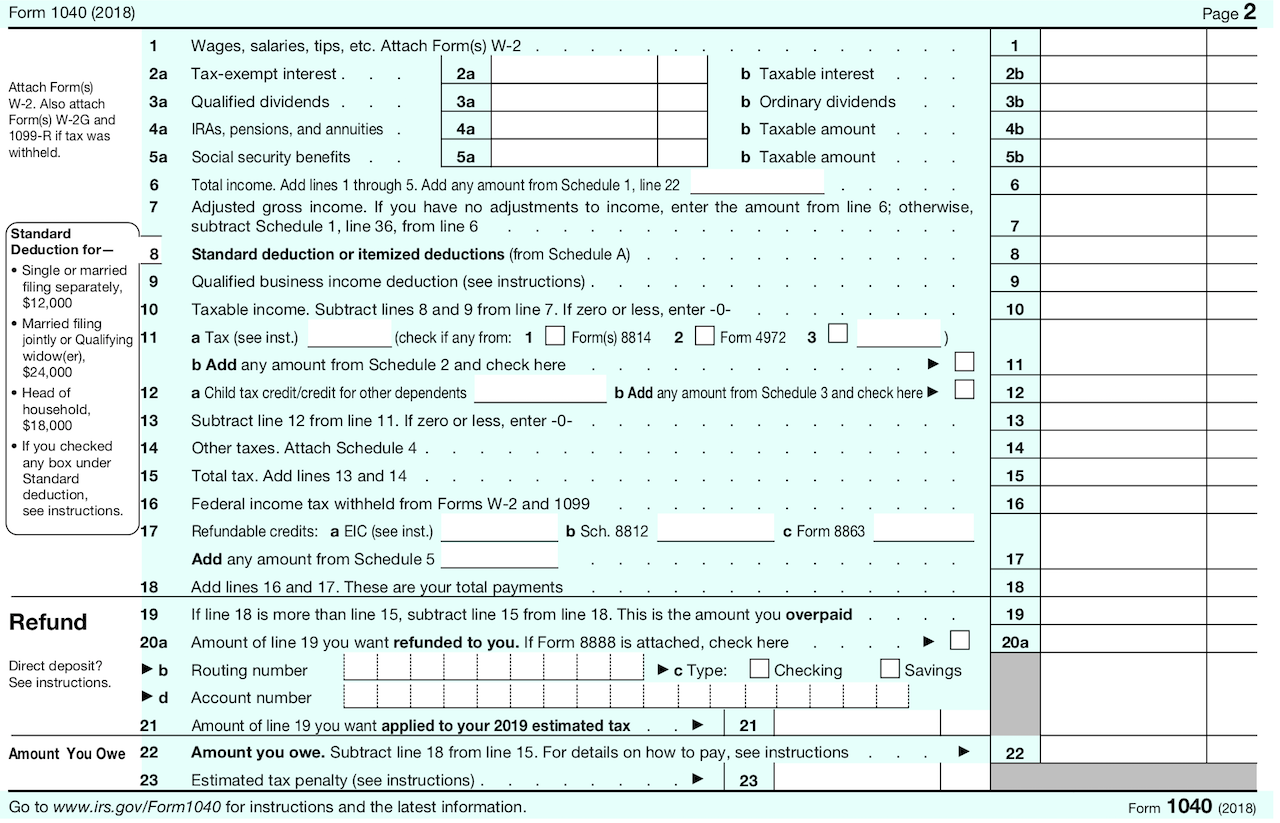

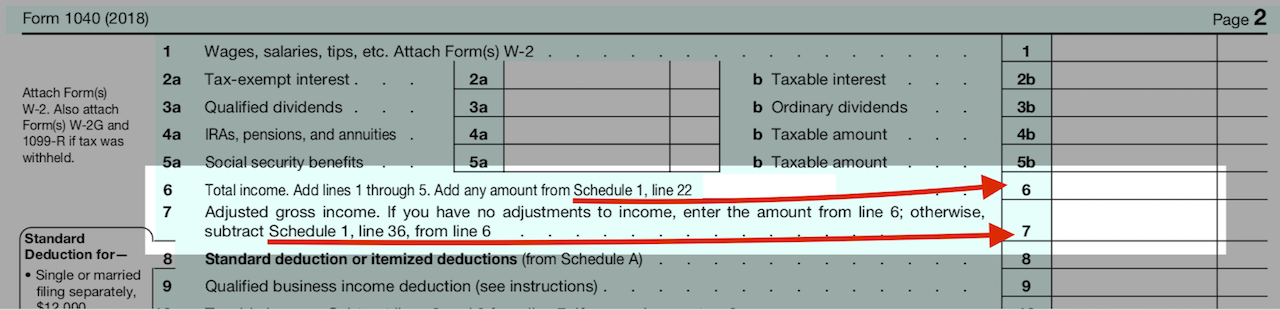

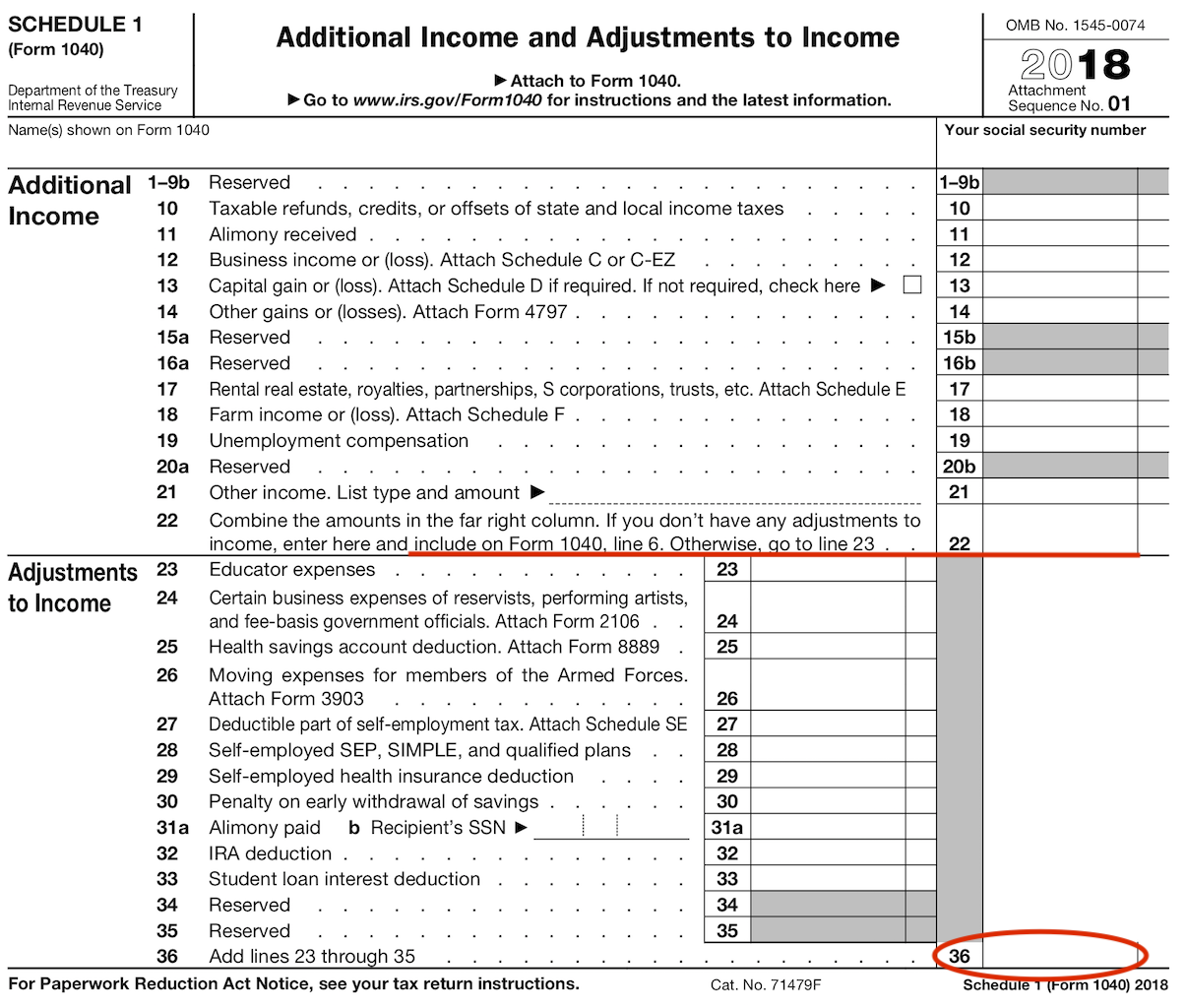

Schedule 1

Additions to Income & Adjustments to Income

Accumulate the additional income items on Sched 1, Line 22 and carry to Line 6 of the tax return.

Accumulate the adjustments to income on Sched 1, Line 36 and carry to Line 7 of the tax return.

FORM 1040

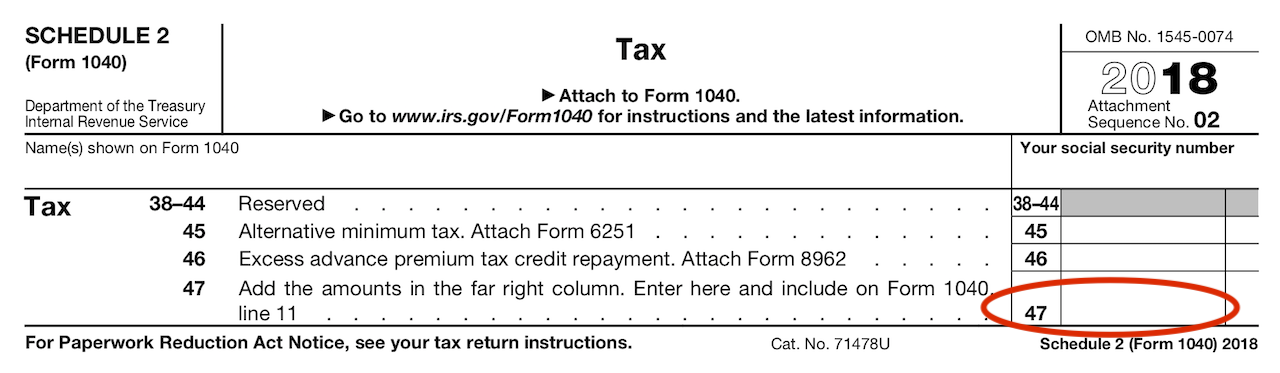

Schedule 2

Tax

Schedule 2 consists of 2 tax items.

Alternative Minimum Tax (AMT) and

Excess Advance Premium Tax Credit Repayment.

The good news for volunteers is that AMT is outside our Scope of Service and the Excess Advance Premium Tax Credit is calculated automatically by the TaxSlayer software.

This leaves us with very little interaction with Schedule 2.

Schedule 3

Nonrefundable Credits

These are the same nonrefundable credits as were present on the 2017 Form 1040. Nothing new here.

Side note about the quality of these tax credits.

As the name ‘nonrefundable’ indicates, the best these credits can do is reduce the tax you owe to zero.

Let’s say you are eligible for $4,000 in nonrefundable credits and your tax bill is $350. In this example, $350 (tax owed) - $4,000 (tax credits) = $0 (tax owed).

Therefore, the presentation of your nonrefundable tax credits may take on a strange look as they are applied to your outstanding tax owed.

The nonrefundable credits are being applied to the tax balance in a specific order and are being evaluated against the moving declining balance of your tax bill such that when the tax owed reaches zero, the tax credit that may have been calculated at $800 on the tax credit worksheet will be displayed as $43 (the number that brings the tax balance to zero) on Schedule 3.

When an unexpected amount appears in relation to nonrefundable credits, it is a good indication that the tax owed is equal to zero and the limitation of these credits has been reached.

Refer to the total on Schedule 3, Line 55 to determine whether that balance is equal to the tax owed on your tax return, Line 11.

Schedule 4

Other Taxes

We will see Schedule 4 quite a bit. It will be generated if your tax client

operates his or her own business and pays Self-employment tax on Schedule SE (Line 57).

must pay Additional tax (on Line 59) for early withdrawal of qualified retirement investments.

will make a Shared Responsibility Payment (on Line 61) for failure to have MEC.

In general, we seldom see the other items on this Schedule or they are Out of Scope.

Schedule 5

Other Payments and Refundable Credits

The common reasons that Schedule 5 will be generated are if your tax client

made estimated tax payments throughout the year (Line 66)

is receiving Premium Tax Credit (this amount flows from reconciliation of Marketplace Ins on Form 8962) (Line 70)

filed an extension and made a payment at that time (Line 71)

Schedule 6

Foreign Address and Third Party Designee

There are two items that will trigger the automatic generation of Schedule 6.

First, when the taxpayer’s address is entered into the TaxSlayer tax software, there is a ‘tick box’ to indicate the address is in a foreign country. That tick box is located just before you type the address lines in TaxSlayer.

Second, if the taxpayer would like to name someone who would be allowed to talk about the return for them (a third party designee), then fill out the complete section for Third Party Designee Info section of the eFile page in TaxSlayer. This will automatically check the “Yes” box on Schedule 6.

These are uncommon situations at Maine tax sites so the Tax-Aide volunteer just needs to be aware of the purpose of Schedule 6 and follow tax software prompts.